irs.gov unemployment tax refund status

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break.

How To Get Irs Tax Transcript Online For I 485 Filing Usa

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

. The tax agency recently issued about 430000 more refunds averaging about 1189 each. - You can start checking on the status of your return sooner - within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return. Using the IRS Wheres My Refund tool Viewing your IRS account information Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

The IRS says it plans to issue another batch by the end of the year. In order to use this application your browser must be configured to accept session cookies. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. Please ensure that support for session cookies is enabled in your browser. Heres how to check your tax transcript online.

In total over 117 million refunds have been issued totaling 144 billion. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan. Using the IRSs Wheres My Refund feature Viewing the details of your IRS account Making a phone call to the Internal Revenue Service IRS at 1-800-829-1040 You may have to wait a long time to speak with someone.

The IRS will continue reviewing and adjusting tax returns in this category this summer. There is no right to privacy in this system. Theres no need to call IRS unless Wheres My Refund.

The refunds totaled more than 510 million. - Its updated every 24 hours - usually overnight -- so you only need to check once a day. Tells you to do so.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The IRS effort focused on minimizing burden on taxpayers so that most people wont have to take any additional action to receive the refund.

This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits. Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities. Unauthorized use of this system is prohibited and subject to criminal and civil penalties including all penalties applicable to willful unauthorized.

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Tax Return Delays Irs Holds 29 Million Returns For Manual Processing

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

2022 Irs Tax Refund Breaking News Refunds Extended Delays Cp2000 Notice Tax Topic 152 Irs Youtube

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

List Of Tax Forms And Tax Schedules Taxact Blog

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

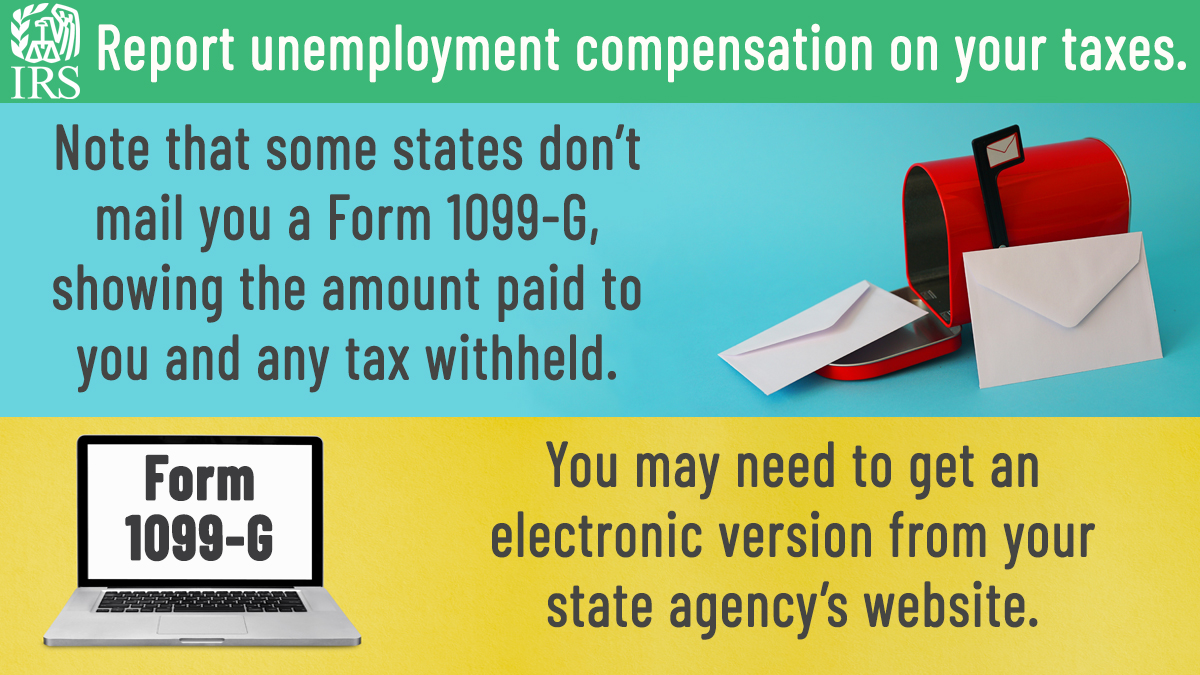

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

Irs Tax Forms What Is Form 1040 Sr U S Tax Return For Seniors Marca

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Using Your Irs Tax Transcript To Get Updates On Your Refund Direct Deposit Date Youtube

Tax Preparation Checklist Tax Preparation Income Tax Preparation Tax Prep

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide